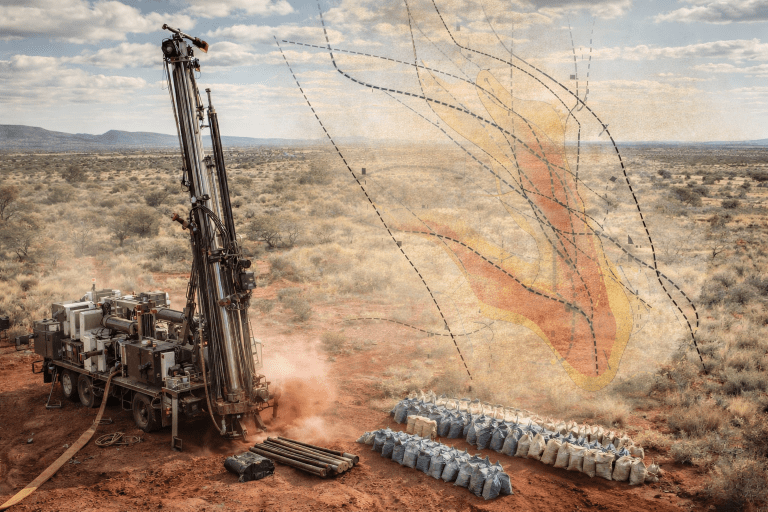

Pantera Lithium (ASX: PFE) has entered into a binding agreement to sell its Smackover lithium brine project in Arkansas, USA, to U.S.-based lithium technology firm Energy Exploration Technologies Inc. (“EnergyX”) for A$40 million.

The sale includes approximately 35,000 gross acres of lithium mineral leases held via Pantera’s subsidiary, Daytona Lithium Pty Ltd.

The consideration comprises A$6 million in staged cash payments and A$34 million in EnergyX common stock. Pantera will receive 2,344,828 EnergyX shares priced at USD $9.50 each, or approximately A$14.50 per share.

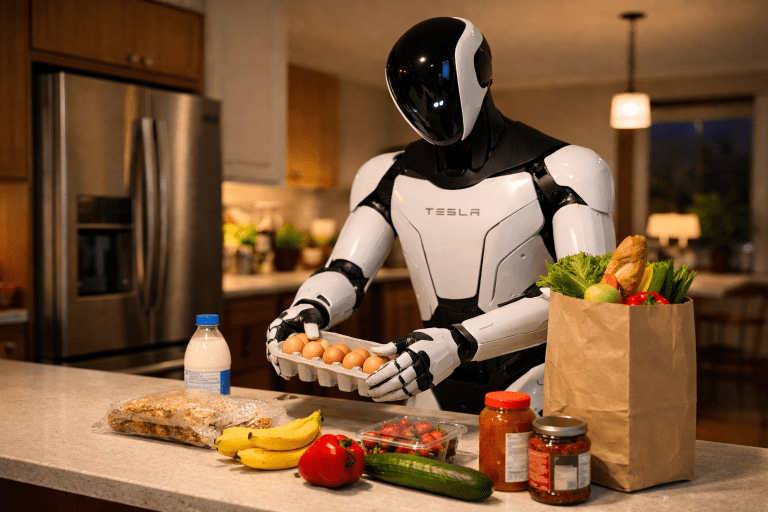

Read Stock Surge’s article called “EnergyX Explained…“

Transaction Structure and Timing

The A$6 million in cash will be paid in three tranches: A$2 million at completion, A$2 million after nine months, and the final A$2 million at 18 months. Completion is expected by 1 October 2025, subject to conditions including Pantera shareholder approval and due diligence.

Additionally, Pantera will dispatch a notice of meeting to shareholders to seek approval for the sale, as the deal involves the disposal of its main undertaking.

Strategic Exposure to EnergyX Portfolio

The deal provides Pantera shareholders with retained exposure to the recovering lithium market via its shareholding in EnergyX. The U.S.-based company is advancing multiple large-scale lithium projects, including Project Black Giant™ in Chile and Project Lonestar™ in Texas.

EnergyX’s CEO Teague Egan stated: “This acquisition represents a transformative milestone. With 35,000 acres positioned adjacent to Exxon, Chevron, and Standard Lithium in the Smackover, the race is on to see who will be the first to produce commercial battery-grade lithium.”

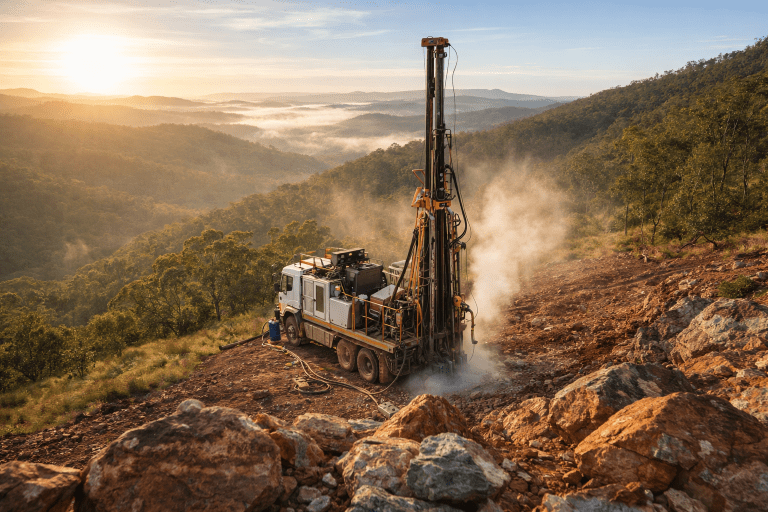

Pantera Positions for Critical Minerals Expansion

Executive Chairman Barnaby Egerton-Warburton said, “This is a game-changing transaction for Pantera. It confirms the significant potential of our Smackover Project.”

He added that the deal enables Pantera to retain “strong exposure to the Smackover play” and access EnergyX’s “Project Black Giant™ in Chile, targeting production in 2027.”

Pantera is now actively reviewing global critical mineral projects and expects to update the market on new opportunities shortly.

Under the agreement, a 180-day exclusivity period has been granted to EnergyX. A break fee of 2.5% will apply if Pantera accepts a superior offer during this period. Following completion, Pantera may either distribute the EnergyX shares to shareholders in-specie or retain them until a future EnergyX IPO.