Pantera Lithium (ASX: PFE), with a market capitalisation of around A$10 million, has reported an uplift in the value of its cornerstone investment in Energy Exploration Technologies Inc. (EnergyX). The revaluation follows EnergyX’s decision to lift the price of its Regulation A capital raise from US$10.00 to US$11.00 per share.

Pantera holds 2.34 million EnergyX shares, originally acquired (received following sale of their Smackover assets) at US$9.50. The new pricing places the value of its holding at approximately A$39.5 million, representing a paper gain of around A$5.4 million since acquisition.

Improving Lithium Market Fundamentals

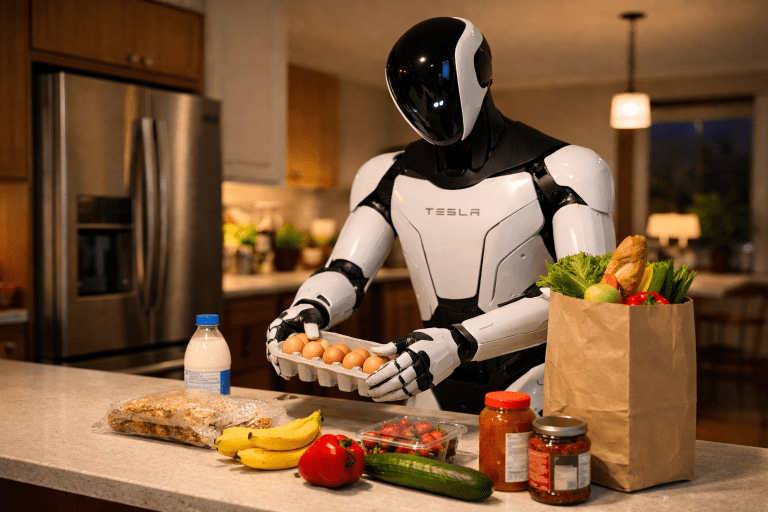

The valuation uplift aligns with a broader rebound in global lithium pricing during 2025. Renewed U.S. investor interest in domestic lithium assets has coincided with EnergyX’s continued progress across its project portfolio. The company’s Texas Lithium Hydroxide Facility is advancing, while rollout of its proprietary Direct Lithium Extraction (DLE) technology continues to scale.

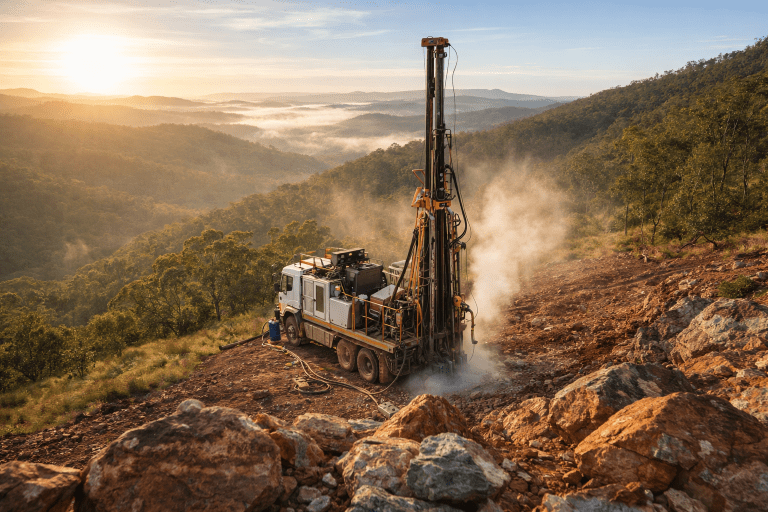

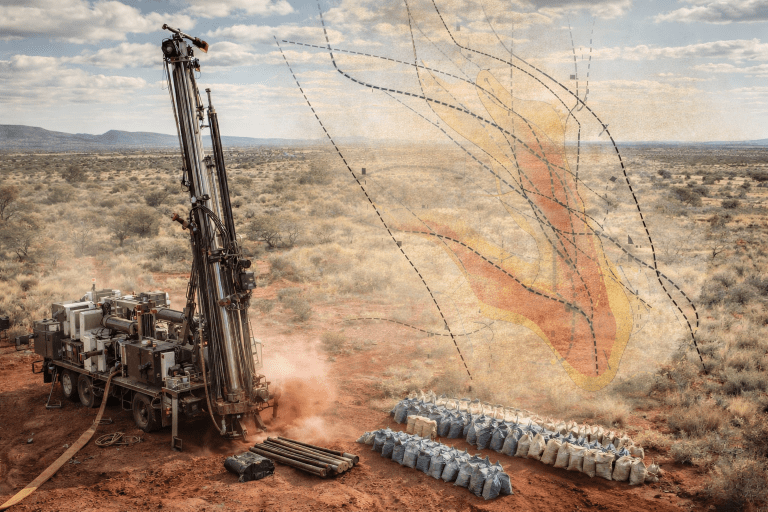

Pantera’s exposure to this growing U.S. critical minerals ecosystem provides asymmetric leverage for a small-cap company whose balance sheet remains strong, with around A$2 million in cash. Its next US$2 million payment to EnergyX is due on 1 July 2026, leaving the company fully funded for its current exploration programs in Southwest Arkansas.

Institutional Support Strengthens EnergyX’s Position

EnergyX recently engaged Goldman Sachs as financial advisor for partnerships and market access initiatives. In a further boost, the U.S. Export–Import Bank (EXIM) issued a US$690 million letter of interest to support project finance for EnergyX’s Black Giant Project in Chile. These developments underline growing institutional recognition of EnergyX’s role in strengthening the U.S. lithium supply chain — a key policy priority under Washington’s energy transition strategy.

Pantera Chairman and CEO Barnaby Egerton-Warburton said: “The uplift in EnergyX’s raise price confirms what the market is recognising — a clear rebound in lithium sentiment and renewed confidence in the U.S. critical minerals sector. Our early partnership with EnergyX continues to add value for Pantera shareholders as the EnergyX platform matures.”

Read more about Pantera Lithium Ltd here: Nanocap Pantera Agrees to Sell Smackover Lithium Project…