Condor Energy (ASX: CND) has enlarged its flagship offshore Peru target after defining a western extension to the Raya structure. The addition lifts the Greater Raya Prospect to more than 900 million barrels of oil (*2U gross unrisked). The new Raya West area contributes 341 million barrels, or 273 million barrels net to Condor.

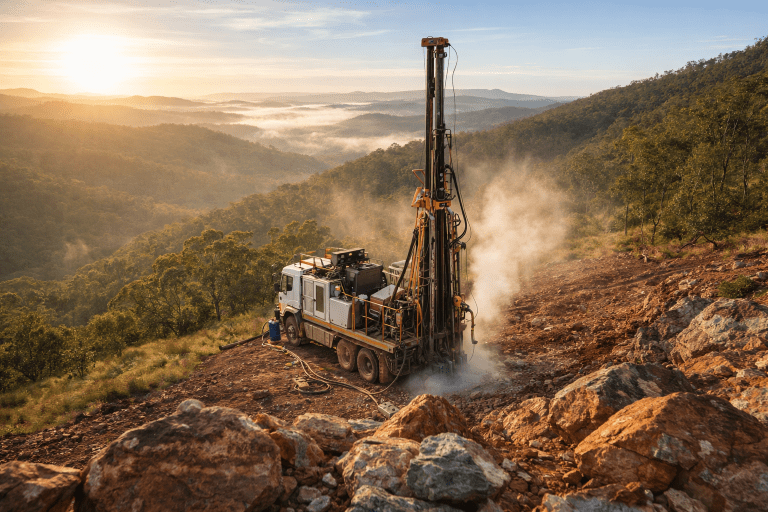

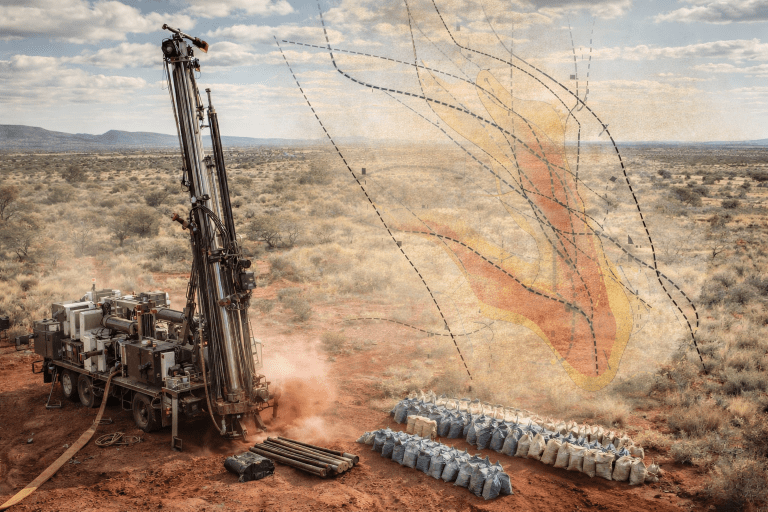

The upgrade follows fresh seismic interpretation across the Tumbes Basin acreage. Multiple stacked Class II and Class III A-V-O anomalies were mapped within the proven Zorritos Formation. These responses are consistent with thick hydrocarbon-bearing sands seen in nearby fields.

Managing Director Serge Hayon said: “Together, Raya and Raya West now form a Greater Raya prospect containing more than 900 million barrels of gross unrisked 2U Prospective Resources.” He added the scale creates a highly material drilling opportunity.

Condor’s broader exploration portfolio now exceeds 3.3 billion barrels of oil 2U gross unrisked across six prospects. The company holds 80% of the Technical Evaluation Agreement with partner Jaguar on 20%.

Gas commercialisation steps at Piedra Redonda

During the quarter Condor executed a Memorandum of Understanding with Promigas Perú S.A. to evaluate gas supply from the Piedra Redonda field. The parties will study pipeline, power generation, compressed natural gas and small-scale LNG options in northern Peru.

The non-binding framework supports assessment of long-term offtake structures. Promigas brings existing infrastructure and market access in the region. Condor also held talks with several other potential buyers, feeding into a staged commercial strategy for the one-TCF contingent resource.

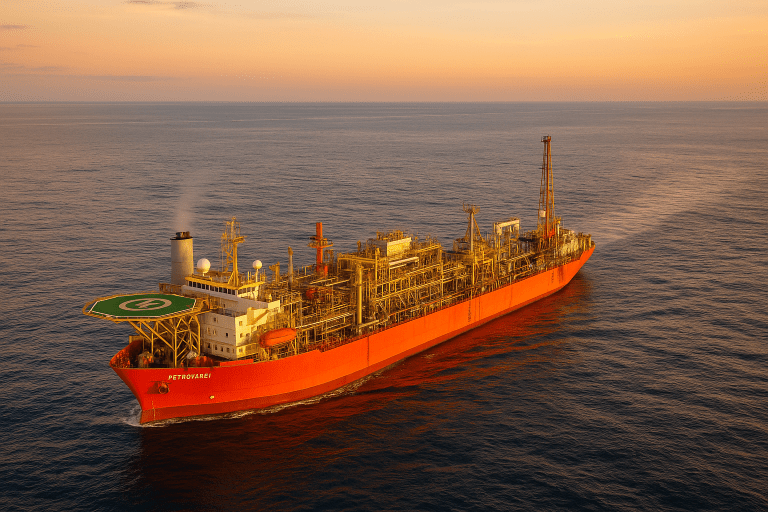

Majors return to Peru’s offshore

International operators are committing capital to Peru’s Pacific margin. The Chevron–Anadarko–Westlawn consortium is targeting blocks Z-61, Z-62 and Z-63 in the offshore Trujillo Basin, around 50 nautical miles, or 92 kilometres, from the coast off the Lambayeque and La Libertad regions.

Condor’s Tumbes Basin TEA sits further north and covers virtually the entire Tumbes offshore acreage. The two areas are distinct sedimentary basins, not contiguous, yet both form part of Peru’s broader offshore hydrocarbon frontier. The entry of global producers provides a benchmark for regulatory progress and technical appetite in the country.

Financial position and technical pathway

Condor closed the December 2025 quarter with $1.93 million in cash. LAB Energy Advisors is assisting with partnering discussions across the portfolio. The Raya West estimate used workflows aligned with earlier independent studies and regional analogues.

Greater Raya lies among established discoveries in shallow to moderate water depths. The company plans further work to refine well design and development concepts ahead of a potential first exploration well.

Peru remains lightly explored offshore despite decades of onshore production. A commercial discovery could feed power and industrial demand in northern Peru, where gas infrastructure is expanding.

Note: 2U represents the Best Estimate (P50) Prospective Resources, meaning the most likely amount of oil that could be recovered if a discovery is made and developed. It aligns with P50 probability, indicating a 50% chance the recoverable volume is higher and a 50% chance it is lower than the stated figure.